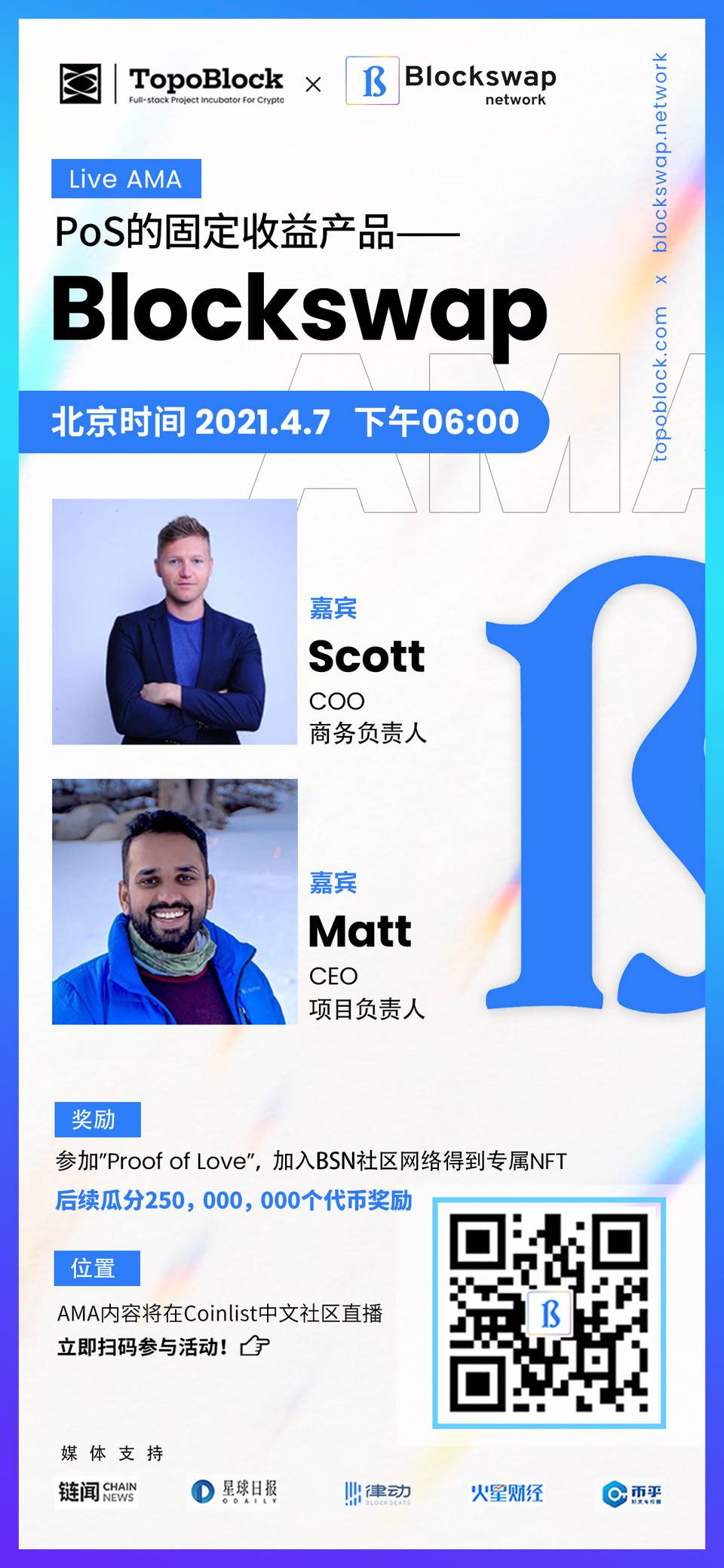

2021 年 4 月 5 日,TopoBlock 与 Blockswap 联合举办了 AMA 活动,本次 AMA 邀请了 Blockswap 联合创始人 Scott 围绕 Blockswap 当前状况,生态发展等问题进行里深入探讨,同时回答了中文社区朋友们的问题。以下是本次 AMA 的文字回顾。

Mesa:大家好,欢迎参加今天由 TopoBlock 在 Coinlist 中文社区和同时举办的 AMA。

Hi everyone! Welcome to the AMA hosted by TopoBlock. This AMA will be simultaneously live streaming in Coinlist Chinese community.

Mesa:我是今天的主持人 Jerry,TopoBlock 的创始人。

I’m Mesa, the host of today’s AMA. I’m also the co-founder of TopoBlock.

Mesa:本次活动由星球日报、链闻、律动、金色财经、火星财经、Coinlist 中文社区支持。

This AMA is sponsored by Odaily, ChainNews, Blockbeats, Jinse, Mars Finance and Coinlist Chinese Community.

Mesa:感谢他们的支持,AMA 的内容将在结束后发布到以上所有平台以及 Blockswap 和 TopoBlock 的所有官方渠道。

Thanks for the sponsorship. The content of today’s AMA will be published on those media mentioned above and all the official channels of Blockswap and TopoBlock afterwards.

Mesa:今天的 AMA 活动分为两个环节,第一个环节为主持人对话环节,主人和嘉宾一对一针对项目本身进行问答。第二个环节,自由问答。第一个环节请大家不要发言,尊重嘉宾,谢谢配合。

This AMA has two segments. First, it will be Q&A based on the project itself between the host and the guest. SECond part will be a Free Q&A. All participants can ask the guest anything. In the first part, please don't speak. Respect guests. Thank you for your cooperation.

Mesa:在活动开始前容我先简单介绍下 TopoBlock。Topoblock 是一个区块链行业一站式市场咨询服务和知识分享平台。专注于寻找 Web 3.0 中的独角兽项目并与其共同成长。

Before we start, please allow me to briefly introduce TopoBlock. TopoBlock is a blockchain company which provides one-stop marketing consulting and service, as well as a sharing platform for various blockchain insights and info. We aim at seeking the UnICOrn projects on Web 3.0 and continuously develop togETHer with them.

Mesa:今天邀请的 AMA 嘉宾是固定收益协议 Blcokswap 的 COO, Scott。

The AMA guest invited today is the COO, Scott of Blockswap, a fixed income Protocol.

Question part

Mesa:欢迎 Scott 来做 AMA。

Thank you for joining this AMA, Scott. Welcome!

Mesa:您好 Scott,首先您可以先简单的介绍一下团队成员以及 Blockswap 是做什么的吗?Hi Scott, can you first briefly introduce the team members and what Blockswap does?

Scott: here with Matt also my Co-founder and CEO of BlockSwap

和我一起参加的是 Matt,他是我的联合创始人,同时也是 BlocSwap 的 CEO。

Matt:I am coming from a Blockchain architect who specialized in cross chain, PoS architecture also headed the multi-chain asset tracking network DSCAN and Social money platform woolah prior to blockswap.

我是一个区块链架构师,我的专业领域是跨链,PoS 架构,多链资产追踪网络 DSCAN。在创立 BlockSwap 之前我在社交代币平台 Woolah 工作。

Scott:COO / Commercial Lead of BlockSwap. I entered the blockchain sector in 2014, I previously held the role of Director of Global Business Development at Wanchain, a blockchain protocol focused on cross-chain smart contracts. Prior to BlockSwap I have been building and leading WeWork’s Blockchain focused incubator where I have been part of the growth in launching Labs into 86 locations across 19 countries. I helped to support 30+ startups in London in the areas of growth and operations including companies (MakerDAO, Celsius, Chainlink) and mentors from (Binance, Pantera, Tezos). Forbes

我是 BlockSwap 的 COO 以及商业负责人。我从 2014 年开始进入区块链行业,我之前在 Wanchain 担任全球商务拓展总。Wanchain 是一个专注于跨链智能合约的协议。在创立 BlockSwap 之前我一直在建立和领导专注于区块链的 WeWork 孵化器,我参与过 19 个国家 86 个地区的不同项目。我在伦敦协助过超过 30 家的区块链创业公司的发展和运营,其中包括 MakerDAO,Celsius,Chainlink,以及来自 Binance,Pantera,Tezons,Forbes 的导师。

Mesa: 固定收益为什么重要?为什么要选择 PoS 资产做固定收益产品而不是 PoW 资产?

Why is fixed income important? Why choose PoS assets to make a fixed income product instead of PoW assets?

Matt:Unlike the Proof-of-Work consensus mechanism used on the Bitcoin network and the current Ethereum network (which is being upgraded to a PoS protocol), verification of transactions does not require the expenditure of vasts amounts of computing power in a competitive race to broadcast the correct solution to a cryptographic puzzle.

Instead, proof of stake requires only that a validator stakes an agreed amount of native tokens of some other asset to the network in order to participate in the verification process and to partake of the rewards that accrue.

PoS networks are able to operate with far higher transaction throughput and more cheaply, which is a win-win for deployment in enterprise and real-world consumer-facing networks.

不同于目前用于比特币网络的 PoW 共识机制和目前的以太坊网络(已升级到 PoS 协议),PoS 交易验证不需要大量算力的花费用以在加密货币的拼图世界中去传播正确的解决方法。PoS 仅仅需要一个验证器质押一笔与原生代币价值相同的其他资产到网络中去,就可以参与验证过程并得到奖励分成。PoS 网络能够以更便宜的价格处理更大的交易量,这对于企业部署以及现实世界中面对消费者的网络来说是双赢的。

Mesa: 可以给我们介绍一下你们的所有产品的运作机制吗?

Saver、StakeHouse、Opensaver 都在网络中发挥什么样的作用?它是如何做到无论存入的不管是法币或者数字货币,都可以保证年固定收益率 7% 呢?

Can you tell us about the operation mechanism of all your products? What role do Saver, StakeHouse, and Opensaver play in the network? How does it guarantee an annual fixed rate of return of 7% regardless of whether it is deposited in fiat currency or digital currency?

Matt:OpenSaver is new architecture from ground up for a sustainable saving market for mainstream. Every asset in OpenSaver ecosystem will have fixed native yield. In this case SaverUSD has 7% which comes from a Bonded PoS Asset collateral backing that deposit. Market has an opportunity to bond SaverUSD deposit with PoS Asset keeping 150% ratio and go long on Pos asset value getting a Balanced Exposure. OpenSaver smart contract will make sure the assets are maintained and well with collateralization ratio.

OpenSaver 是从零开始的一种新型架构,对于主流来说是一种可持续的节约市场。OpenSaver 生态中的每一种资产都会有固定的原生收益。这种情况下,SaverUSD 的 7% 收益率来自于与之绑定的 PoS 资产保证金。市场有机会将 SaverUSD 的存款与 PoS 资产绑定,以保证 150% 的收益,同时 PoS 资产的价值也会获得平衡占比。OpenSaver 智能合约将会保证资产维持在一个健康的保证金率。

Mesa: StakeHouse 相对与其他的 AMM,比如 Uniswap, 它有什么独特的地方?

What is the difference between StakeHouse and other AMM,like Uniswap, what is unique about it?

Matt:StakeHouse is an Automated Asset Market Maker (AMM). It is a simple share registry that allows node operators to register their node and associated validators on-chain in order to permit liquidity abstraction.

A SLOT is a perpetual bond which pays out staking rewards and represents the equity of a specific StakeHouse. A StakeHouses’s book value being its total Staking Balance of all 32ETH batches combined at any given time. A StakeHouse’s market value being deterministic of its ETH2 Staking Performance.

StakeHouse 是一个自动做市商。它是一个允许各个节点操作员注测他们的节点并与链上验证者相关联的简单的过户登记机制,用来防止流动性流失。SLOT 是一个用来支付奖励的永续债券,同时也代表了特定 StakeHouse 的抵押资产。StakeHouse 的账面价值是由任意时间的批次所组合的价值 32 个 ETH 的总质押资产。StakeHouse 的市场价值是由它的以太坊 2.0 的质押表现所决定的。

Mesa: 可以和我们聊一下代币的情况吗?CommunityNet 代币是什么?它有什么作用?它的价值在哪儿里?我们如何获得 CN 代币?

What is the CommunityNet token? What does it do? Where is its value? How do we get CN tokens?

Scott: We are launching launching our ETH2 CommunityNet (CN) through a protocol market fit exercise which is going live in April. The CN shall launch a unique token incentive scheme bootstrapping our genesis community.~250,000,000 tokens will be distributed through a incentivized CN phase across 5 months.

For full details of the CommunityNet and Token here also ? https://blog.blockswap.network/incentivized-communitynet-with-fair-token-launch-66f8925d81d9

CommunityNet is to drive a better alignment between users and our products intended functional utility. We want to enable users to test our products in a safe environment and allow us to improve on the UI. Users shall also learn how our AMM coordination layer works.We reward users through CommuntiyNet token for their participation. At the same time we build a foundational user base for the mainnet going live in 6 months. Communitynet token is redeemable 1:1 with Mainnet token.

我们即将在 4 月通过协议市场发布以太坊 2.0 的社区网络(CommunityNet,CN)。CN 将发行一款独特的代币来刺激我们的创世纪社区发展。250,000,000 个代币将会在 5 个月内通过社区参与激励的方式释放。

详情请见:https://blog.blockswap.network/incentivized-communitynet-with-fair-token-launch-66f8925d81d9

CommunityNet 会让用户和产品在功能性方面更好地进行匹配。我们想让用户能够在安全的环境中测试我们的产品,并且让我们可以改进我们的 UI。用户还将会学习到我们自动做市商是如何协调运作的。我们会通过 CommunityNet 代币给我们的用户发放参与奖励。

6 个月内,我们还将建立一个为主网服务的功能性的用户基础。CommunityNet 代币是可以 1:1 兑换主网代币的。

Proof of Love - Join the Club!

As part of the CommunityNet we are excited to give 100 AMA participants here now access to join the CommunityNet by completing the Google Form. https://forms.gle/NSzpCcpCWUA8ogVV9

The form shall remain open for 60mins after the AMA ends. Follow BlockSwap TG for updates - CommunityNet is going to be very exciting!

CommunityNet is through an interactive, gamifyed experience on Telegram and later Discord.

Proof of Love — 加入我们!作为 CommunityNet 活动的参与者,我们很高兴地为 100 位参加 AMA 并完成以下表格的观众们提过进入 CommunityNet 的权限。https://forms.gle/NSzpCcpCWUA8ogVV9

AMA 结束后的 60 分钟内,表格填写通道都会保持开通状态。关注 BlockSwap Telegram,追踪关于 CommunityNet 的最新动态。

CommunityNet 将会在 Telegram 以及 Discord 上以交互性、游戏性的体验呈现。

Mesa: 我没有找到你们的 roadmap, 能和我们大概透露一下 Blcokswap 的接下来会做什么吗?

I didn't find your roadmap on website, can you tell us about what Blcokswap will do next?

Scott:April - CommuntiyNet for ETH2 + Algorand April - Balancer LBP + Uniswap for CommunityNet Token Launch *BlockSwap is part of the Algorand EU Accelerator https://algorand.foundation/news/accelerator-europe Then Launching Open Saver - Universal Basic Savings Account Scheme for ETH/ALGO. Next Chains (DOT, ADA)

四月:CommunityNet 上线以太坊 2.0 + AlgorandCommunityNet 代币通过 Balancer LBP + Uniswap 发行BlockSwap 是欧洲 Algorand 加速器伙伴之一 https://algorand.foundation/news/accelerator-europeOpenSaver 发布ETH/Algo 部署于全球基本储蓄账户计划其他上链(DOT,ADA)

Mesa:感谢 Scott 的精彩分享,我们第一阶段的 AMA 就到此结束了,现在开启第二个环节,自由问答环节,嘉宾将选取 5 个问题进行回答。

Thank you so much for sharing, Scott. That is our first segment of today’s AMA. Now it is the Free Q&A part. Scott will choose 5 questions to answer.

自由问答

belive:Blcokswap 后续会多链发展吗?例如波卡链,heco 链这些。以及治理方式是什么样的?如何解决 gas 费这些问题?是否考虑添加可视化 UI?海外社区发展情况?获得 CommunityNet 权限有什么奖励呢?

Will blcokswap have multi chain development in the future? For example, Boca chain, heco chain and so on. And what is the way of governance? How to solve these problems? Consider adding visual UI? Overseas community development? What's the reward for getting permission to communitynet?

Scott:Yes. We are currently focused on ETH2, Algo then DOT and ADA for Multi-chain Open Saver. The CommunityNet we shall be adding more UI and UX refinement. Users can also vote for earning more rewards for liquidity in Pancake and Sushi and other that communty want.~250,000,000 tokens will be distributed through a incentivized CN phase across 5 months.Communities are growing fast in west. We have dedicated team in China. Winkrypto, dedicated Wechat manager. CDI investor is extremely supportive to us also.

是的,我们目前将重点放在 ETH2.0,Algo。之后会继续在 DOT 和 ADA 发展多链 OpenSaver。关于 CommunityNet,我们会进行更多的 UI 和 UX 方面的优化。用户可以进行通过投票获得更多在 Panckae 和 Sushi 上的流动性奖励,以及其他一些社区所需要的东西。250,000,000 个代币会在 5 个月的时间里通过 CommunityNet 激励的方式进行分发。西方的社区增长速度很快。我们在中国也有很棒的团队,Winkrypto,来进行微信管理。CDI 投资方对我也十分的支持。

杰米:I saw the fair token lanuch plan in your medium, can you provide more details?

我在 medium 上看到你们的代币公平分配计划,可以提供更多细节信息吗?

Scott: Yes, fair launch shall start on Balancer LBP to distribute token as fairly as possible. The Uniswap shall launch 3 days later.

是的,从 Balancer LBP 开始公平发行,这样可以尽可能地公平地分配代币。 而 Uniswap 将于 LBP 的 3 天后启动。

老妹儿:What is your current target market? What are the plans for rapid growth in terms of users, global markets and partners?

您目前的目标市场是什么? 在用户,全球市场和合作伙伴方面,有哪些快速增长的计划?

We focus on 2 types of users.

Users who want to stake their base native token and earn higher yielding inflationary rewards.

Users who want to bring fiat and earn a sustainable APY Savings without having to touch PoS themselves.Open Saver Universal Basic Savings backed by a PoS bond market that guarantees a USD saver account with around a 7% interest from staked assets.For stakers we have simplified the staking process and isolated the slashing risk where we enable stakers to bring 32ETH and join a specific onchain staking node called a Stakehouse. In return for their 32 ETH a users receives 24dETH with dETH being a 100% non slashable 1:1 token to their undying stake (i.e liquid staked ETH) and 8 SLOT token which is the perpetual bond token representing the equity of stakehouse node.

我们关注两种类型的用户。-希望押注其基础原生代币并赚取更高收益的通胀奖励的用户。-那些想要购买法币并获得可持续的 APY 储蓄,而不需要自己去购买 PoS 的用户。PoS 债券市场为美元储蓄账户提供担保,其持有资产的利息约为 7%。对于参与者来说,我们简化了下注过程,并隔离了风险削减,使参与者能够携带 32ETH 并加入一个称为“Stake House”的特定链上下注节点。作为对他们 32 个 ETH 的回报,a 用户获得 24deth, deth 是 100% 不可分割的 1:1 代币到他们的不死的股份 (即 liquid stakes ETH) 和 8 槽代币,这是永久债券代币,代表了 stakehouse 节点的权益。

8848 专属坦克:How can Blcokswap generate profit/revenue to maintain your project, and what is its revenue model? How does it make investors and your project win-win?

Blockswap 如何产生利润 / 收入来维持您的项目,它的收益模式是什么? 它如何使投资者和您的项目双赢?

Scott:Token Supply is based on node running and commercial staking within the network, it is actively governed by circulating supplyBSN token holders fee-earning options from Open saver:Minting fees from $aversSaverbond rebalancing swap feesSaverbond excess collateral early withdrawal feesFlashloan fee for using Bond Index asset and $averbond dtoken value.

代币供应基于网络中的节点运行和商业抵押,由流通供应者-BSN 代币持有者主动支配,来自 Open Saver 的费用选项:$ AVERs 的铸币费,Saverbond 重新平衡交易费,Saverbond 超额抵押提前提款费,使用债券指数资产和 $AVER dtoken 价值。

追剧小男孩:How does Blcokswap plan for traditional financial markets? How to realize the connection between cryptocurrency market and traditional financial market and attract traditional financial market to join?

Blockswap 如何规划传统金融市场? 如何实现加密货币市场与传统金融市场之间的联系,并吸引传统金融市场加入?

Matt:Blockswap is trying to bridge DeFi with traditional finance, OpenSaver will be go to place for large capital providers and asset managers to deploy cpaital taking exposre to a PoS asset on a single ERC20 as a curated basket. This is a huge win for PoS chains and token holders. Where traditional financial players dont have to go through 20 different steps of learnign and managing the staking process they get a ready market for deploying capital and take part in Defi Open Saver is designed to hold millions of users with 100,s billions in capital that is protected by PoS asset growth and adoption. There is no risk of excessive market manipulation like we see in exsiting speculative DeFi.

Blockswap 试图在 DeFi 与传统金融之间架起桥梁,OpenSaver 将被大型资本提供者和资产管理者所采用,在一个 ERC20 上将 cPaital 的曝光量部署到 PoS 资产上作为策划篮子。对于 PoS 链和代币持有者来说,这是一个巨大的胜利。传统的金融参与者无需经历 20 个不同的学习和管理赌注流程的步骤,便可以为部署资本和参与 Defi 提供一个现成的市场。

Open Saver 旨在通过 PoS 资产增长和采用来保护数以百万计的用户,拥有 1000 亿亿的资本。就像我们在投机性 DeFi 中所看到的那样,没有过度市场操纵的风险。

油:请问到目前,BlockSwap 与哪些知名项目达成了合作?

Excuse me, so far, which well-known projects BlockSwap has reached cooperation with?

Scott:We have infrastructure partners like Arweave. Wait for the news on StakeHouse, we have max 10 StakeHouse for CommunityNet and big communities and Projects running. Its going to be exciting.

我们有像 Arweave 这样的基础设施合作伙伴。等待关于 Stakehouse 的消息,我们有最多 10 个监视室用于社区网和大型社区和项目运行。会很刺激的 !

清波:What is the audit unit of the project? How much is the market value of the project?

项目的审计单位是哪个? 该项目的市场价值是多少?

Scott:Great question. The CommunityNet is run in a simulated environment, so no loss of funds possible. 5 months of stress testing the protocol with users.Mainnet shall pass through 4-5 audits and a formal verification process*This is a major priority.

好问题。CommunityNet 是在模拟环境中运行的,因此不可能出现资金损失。与用户进行为期 5 个月的协议压力测试。Mainnet 应通过 4-5 次审核和正式验证过程这是一个主要的优先事项。

Mesa:今天的 AMA 就到这里结束了,再次感谢 Scott 的精彩分享

That is the AMA for today. Thank you for sharing the great insights and info with us, Scott.

以下是 Blockswap 官方链接 , 感谢大家对 Blockswap & Topo_Coinlist 中文社区的支持以及关注。

Here is the official link to Blockswap._Thank you all very much for the support and attention to the Blockswap & Topo_Coinlist Chinese community.

Twitter: https://twitter.com/Blockswap_team

Telegram: https://t.me/bsnchat

Medium: https://blog.blockswap.network/

Website: https://zh.blockswap.network/

未来 TopoBlock 将会在各大平台给大家分享优质的知识和内容,请保持关注对 Coinlist 中文社区和 @Topoblock 的关注,我们近期会持续在群内输出关于 coinlist 和其他公募平台上的优质内容。本次 AMA 的所有内容也将发布在所有官方渠道,敬请期待!

90

90

84

84

77

77

76

76

75

75