引言

YIELD根据银行牌照经营业务,提供安全保险和创新型的金融产品,并由在Fintech(金融科技)和网络安全领域拥有多年经验的团队管理。这样可以确保用户始终都可以在YIELD轻松投资并获得收益。

YIELD在刚刚结束的混合融资中筹集了近500万美元。资金来源于多个渠道,包括在线投资平台BnkToTheFuture募得的29.7万美元,还有知名投资平台Alphabit Fund、Digital Strategies、PALCapital、Yeoman's Capital和Chronos VC牵头的340万美元私募金额。私募在12小时内超额认购了三倍。

YIELD已于12月14日在中心化交易所BitMax全球首发,并在去中心化交易所Uniswap也正式上线并发行代币YLD。

以下为AMA全文

思萱:请先做一下自我介绍和项目介绍。

Brief introduction of yourself and The YIELD.

Tim Frost:Tim Frost是YIELD的首席执行官。在Fintech、市场营销,BD和运营方面都有丰富的行业背景和经验,YIELD.app是他创办的第三家数字银行。Tim也是许多成功的金融科技和区块链公司中的关键人物,专门从事早期增长、运营和开发。他曾是Wirex创始团队的一员,在最初的18个月中为运营、业务开发和市场营销提供支持。他还曾加入并帮助EQIBank推销了平均客户资产管理规模(AUM)25万美元的全球数字挑战者银行,也加入并助力诸多初始阶段的区块链初创公司,如QTUM,NEO,Paxful,Polymath,Selfkey,Everex等。

My name is Tim Frost and I am CEO of YIELD

I have a rich Fintech, marketing, business development, and operations background. YIELD.app is my 3rd digital bank and he has been a key figure with many successful fintech and blockchain companies. Specializing in early-stage growth, operations, and development. I was part of the founding Wirex team and supported operations, business development, and marketing for the first 18 months. I also joined and helped take EQIBank to market a global digital challenger bank with an average client AUM of $250,000. I have helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, Selfkey, Everex, and many others.

Justin Wright:在进入Fintech的领域之前,Justin大部分的职业经历在资本市场和基金管理领域。YILED是他第一次投身加密领域。在过去的6年间,他建立了Beehive P2P,这是中东最大的SME P2P贷方,现在已由Tim引入DeFi。Tim正是看到了将加密技术真正推向主流的潜力,因此抓住了这个机会加入了@YIELD.app的创始团队。

I have spent most of my career in capital markets and fund management before moving over to Fintech, this is my first venture in the crypto space. I have spent the last 6 years building out Beehive P2P, the largest SME P2P lender in the Middle East and having been introduced to DeFi by Tim and seeing the potential to really take crypto to the mainstream, I jumped at the chance to be part of the founding team @YIELD.app

Jan Strandberg:我是一名负责公司增长的“增长黑客”,也是数字营销领域的专家,在行业内有超过10年的经验,目前引领着YIELD在各个市场的增长。他曾是Paxful(现在是全球最大的P2P市场)的Marketing主管,在这个领域有着非常成功的经验——不仅将Paxful的用户人数从5万扩大到了450万,也将每周创收从10万美元增长到4500万美元!

Hey everyone, I have been a growth hacker and digital for more than 10+ years and leading the growth at YIELD. I’ve helped successfully scale-up companies in the sphere and I was the head of marketing at Paxful, now the largest P2P marketplace worldwide. I've scaled up Paxful from 50 000 users to more than 4.5 million and from revenue perspective from 100k$ USD to 45 million USD weekly.

YIELD是一家受许可和监管的金融科技公司,任何人可以轻松投资去中心化金融!通过提供直观的手机应用程序和网站,全球用户可以通过平台的DeFi投资策略获得高达20%的年收益(APY)——直接从DeFi产品中获得回报,无需经历冗长、复杂且通常成本高昂的学习过程。我们通过YLD代币提供透明的治理。我们的目标是超越DeFi,提供更有意义的数字银行体验,让大家可以轻松地使用任何货币赚取利息,并使用我们的实物借记卡进行消费,到时将无需考虑加密。

我们受到以下机构和投资者的支持:

https://www.alphabit.fund/

https://bnktothefuture.com/

https://digistrats.com/

https://www.palcapital.com/

https://www.yeomans.capital/

https://chronosvc.com/

David Johnston (Factom)

Trevor Koverko (Polymath)

Eric Gu (Metaverse)

Tim Bos (Sharing)

Dustin Byington (Wanchain)

DuckDAO

Michael Terpin

Jeff Kirdeikis

TrustSwap

我们想简化defi,让更多人参与进来。

YIELD is a licensed and regulated FinTech company that enables anyone to invest in decentralized finance with the touch of a button! Offering an intuitive app and web platform, users around the world can start earning up to 20% APY through our DeFi strategies on the backend, earning returns from DeFi products without having to go through a lengthy, complex, and often costly learning process. We offer transparent governance through our YLD token. Our

goal is to go beyond DeFi and provide a more rewarding digital banking experience, where people can easily earn interest on any currency and spend their earnings using our physical debit card, without ever having to think about crypto.

We are backed by:

https://www.alphabit.fund/

https://bnktothefuture.com/

https://digistrats.com/

https://www.palcapital.com/

https://www.yeomans.capital/

https://chronosvc.com/

David Johnston (Factom)

Trevor Koverko (Polymath)

Eric Gu (Metaverse)

Tim Bos (Sharing)

Dustin Byington (Wanchain)

DuckDAO

Michael Terpin

Jeff Kirdeikis

TrustSwap

We want to simplify defi and also let people with less money to participate.

思萱:DeFi的一个特点是围绕加密货币展开,用户在YIELD上可以用哪些资产参与到DeFi中?

A feature of DeFi is that it`s running around Cryptocurrency, So what cryptocurrencies can users use in YIELD.

Tim Frost:可以用USDT和USDC支付。我们会在后端和投资策略中处理所有问题。

另外,我们一直在寻求整合更多法定货币和加密货币,基本目标是最终使任何人都能无缝体验DeFi投资。敬请大家关注我们之后的消息,全球telegram社群:https://t.me/yieldapp,中文社群:https://t.me/yieldappCN

Paid in USDT and USDC. We handle all the conversations in the backend and strategy.

We’re always looking to integrate more currencies, both fiat and crypto, with the fundamental goal of eventually enabling anyone to invest in DeFi through a seamless experience.

思萱:通过法币参与DeFi是一个很让人兴奋的想法,但法币要如何参与到DeFi当中?

Bring FIAT currency into DeFi is an exciting idea,but how can you make it?

Justin Wright:我们正在与监管机构合作,已经在包括EQIbank在内的FIAT网关建立了强有力的合作伙伴关系。我认为,总体而言东南亚市场存在很多可能性,只是尚未开发。我们希望进入这个尚未开发的市场,并从当地社区中获得帮助,将我们介绍给合适的人,并与我们现有的合作伙伴有效合作。

We are working with regulators and have already strong partnerships around FIAT gateways including EQIbank. I think overall there's a lot of possibilities in the Southeast Asian market and it's still quite untapped. We hope to get into this untapped market and we hope to get help from the community to introduce us to the right people and also use the existing partners that we have.

大多数监管机构都在寻找专业服务提供商,这些公司应当有先进的模式,还应当由能力教育和推动许可制度,而不是与之背道而驰。这与Justin在Beehive和我在EQIBank和Wirex取得的成就一样。

YIELD.app已成功获得科摩罗的离岸银行,证券和基金管理许可证,支持我们的代币发行。通常,获得多个司法管辖区的批准需要时间,因此在这方面,我们一开始就目标明确,并且将在我们之后开展所有活动时继续添加许可证。

我们拥有一套接受监管的计划,并将遵循全球标准,例如MiFID,MiFID II。对于AML,我们与行业领先的注册技术提供商合作,在繁复的KYC与良好的用户体验之间取得平衡。我们正在建立SOC合规技术基础架构和流程,我们的产品和技术测试都有记录,创建者和管理者都是公开的,我们将继续从正面倡导建立大规模采用和公平监督的标准。

most regulators are looking for professional service providers that employ best practice and are also best positioned to educate and drive the licensing regime rather than fight it, the same as Justin achieved with Beehive and I did with EQIBank and Wirex. YIELD.app has already successfully acquired on offshore banking, SECurities and fund management license in Comoros to support our launch. Typically, it takes time to reach multiple jurisdictional regulatory approvals so in that respect we are setting out our intentions from the start and will continue to add licenses as we go for all of our activities. We have a regulatory roadmap and will adhere to global standards as we move forward such as MiFID, MiFID II, for AML we work with industry leading reg-tech providers to strike a balance between over aggressive and cumbersome KYC and a frictionless on-boarding joinery for our users. wWe are building SOC complaint technology infrastructure and processes, we have documented sandboxes for product and strategy testting, the founders and managers are public and we will continue to advocate from the front to set the stndard fro mass adoption and fair oversight.

从MVP开始,我们提供1个DeFi投资产品。我们让你可以很容易地把钱放在YIELD.app上,你的密码基本上可以通过我们投资数十种高收益和安全的DeFi产品。

From MVP launch we are offering 1 DeFi investment product. We are making it easy to put money on YIELD.app and your crypto will essentially be invested in dozens of high yielding and safe DeFi products through us.

思萱:通常的DeFi协议都会用通过代码审计的智能合约来保障用户资产,YIELD在这个方面是怎么做的?

Almost every DeFi protocol would do a successful code audit to show the users that their assets are secure in those projects. How would YIELD ensure the security of users' asset?

Jan Strandberg:YIELD与之交互的所有协议均使用智能合约进行严格的审核,并且我们的基础架构由网络安全专家和DeFi专家设计的一流解决方案。also我们还与业界领先的数字资产托管人BitGo合作,以确保我们的多重签名钱包和金库具有最高级别的安全性。

All protocols that YIELD interacts with are subjected to rigorous audits using smart contracts, and our infrastructure uses best-in-class solutions designed by cybersecurity specialists and DeFi experts. We also partnered with BitGo, the industry's leading digital asset custodian, to ensure the highest level of security for our multi-signature wallets and vaults.

思萱:DeFi的市场前景一直被看好,但因为门槛、难度的问题遇到了瓶颈,CeFi的方式可以怎么帮助突破这个瓶颈?

DeFi's prospect is valued by many people,but due to the drawback of attending diffcultise,it has met some problems. So how can CeFi help Defi with these issues?

Tim Frost:过去,因为DeFi的复杂性、高昂的矿工费、各种各样的欺诈等种种不良的用户体验,大多数加密货币持有人无法参与进DeFi。

这正是我们要解决的问题。目前,用户不可能进行小额投资(至少都需要100美元)。通过CeFi这种集中式金融,我们可以帮用户节省费用,并用有限的资金解决他们的问题。通过一个直观的移动应用程序,用户可以轻松用他们的首选货币存款,然后选择最适合他们的计划。没有矿工费(gas fees)、也没有转账费用,我们的团队会处理复杂的DeFi的问题,免去了普通投资者的种种障碍和烦恼。

DeFi is complex, high gas fees, and a lot of fraud. In the past, a majority of crypto holders cannot participate in DeFi due to those reasons.

This is exactly the problem we are trying to solve. Right now it's impossible for users to make a small, maybe $100 DeFi investment. By having economies of scale, we are able to pass the savings along to our customers and fix their issues with limited capital. We address these specific issues by offering an intuitive mobile app where users simply deposit funds in their preferred currency and select the plan that suits them best. There are no gas fees, no transfer fees, and our team handles DeFi’s intricacies so you don’t have to.

思萱:YIELD可以怎么帮助不熟悉加密货币、不熟悉DeFi的人参与进来获得投资利益?

How can YIELD help those people who are not familiar with DeFi to involve in DeFi and earn interest?

Justin Wright:通过YIELD最方便的手机应用程序和网页版本,任何人都可以轻松进入DeFi的世界。在YIELD,用户只需存入加密货币或法币并选择最适合他们的投资计划即可。

我们根据银行牌照经营业务,提供安全保险和创新型的金融产品,并由在Fintech(金融科技)和网络安全领域拥有多年经验的团队管理。这样可以确保用户始终都可以在YIELD轻松投资并获得收益。作为我们策略的核心,我们的$YLD代币可实现治理透明化,奖励忠实的社区成员并支持社会影响计划。

作为一家经许可和监管的FinTech公司,我们提供了一个安全的数字银行平台,用户可以通过保险的DeFi策略获得高额回报,而这对于个人投资者而言是无法自己复制的。

YIELD makes DeFi accessible to anyone thanks to our intuitive app and web platform, where users simply deposit crypto or traditional currencies and select the investment plan that suits them best.

Operating under a banking license, we offer insured and innovative financial products managed by a team with years of experience in FinTech and cybersecurity. This ensures that our users always feel comfortable earning with us. At the core of our strategy, our $YLD token allows for transparent governance, rewards loyal community members and supports social impact initiatives.

As a licensed and regulated FinTech company, we provide a secure digital banking platform where users can earn high returns through insured DeFi strategies that would be impossible for individual investors to replicate on their own.

思萱:YIELD的代币会在14号正式上线交易所,那YIELD是怎么分布、发行的?有什么价值、场景?

The YIELD token is going to launch exchanges on 14th December. So what is the utility of YIELD token and how would it be distributed?

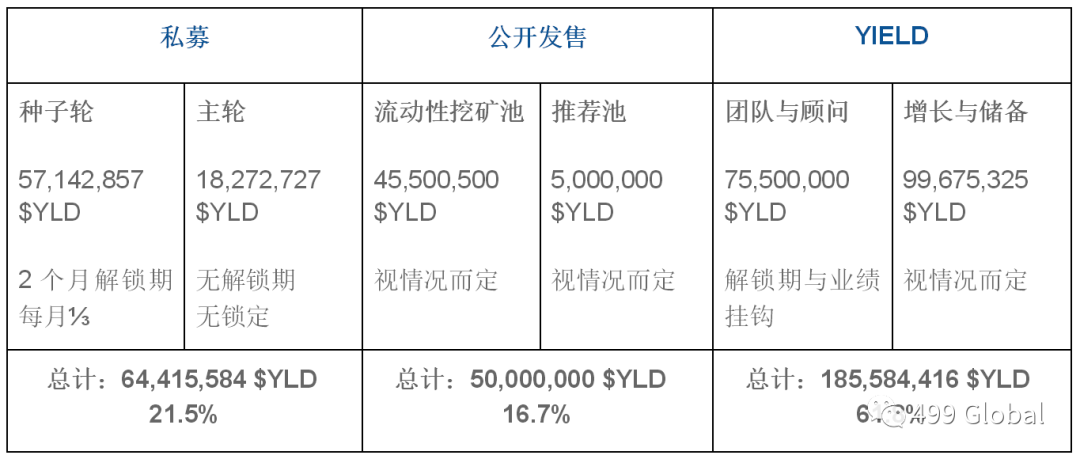

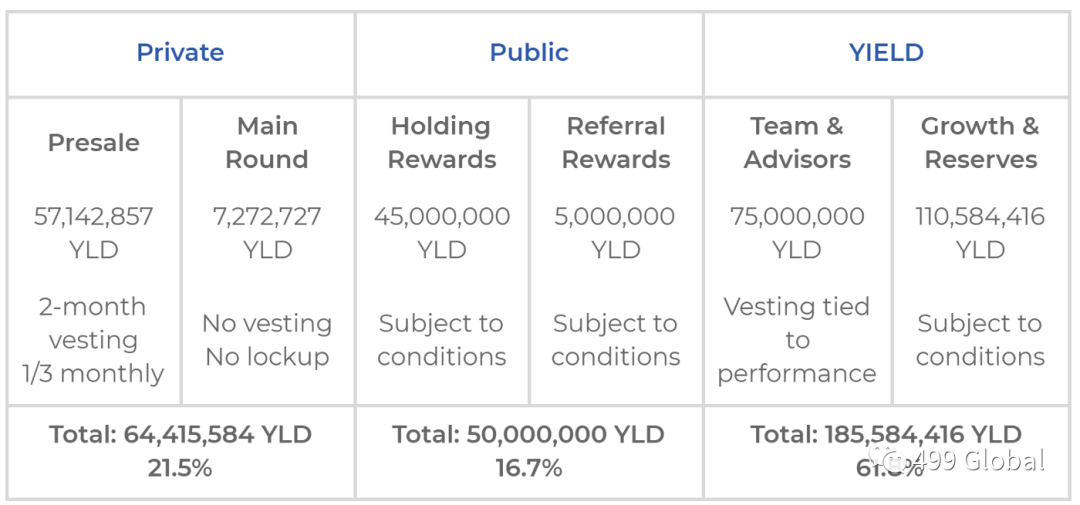

Jan Strandberg:YLD的分配如下:

更多关于持有奖励和推荐奖励的细节可以参考这里:https://yieldapp.medium.com/yield-launching-native-yld-token-5a48f2bb48ac

在发布后的前36周内,我们的早期采用者可以:

1. 在选定投资计划后收到YLD,

2. 将新用户推荐给我们的平台,

3. 使用我们的内置功能获取代币,

或4. 将资产轻松保存在安全的多币种钱包中。

最大供应量是固定的,YLD也可以在交易所交易。

我们很高兴听到大家对我们的代币文档的想法和其他问题:https://medium.com/@yieldapp/yield-launching-native-yld-token-5a48f2bb48ac

它类似于BNB类型的模型。是我们整个生态系统的关键,用于降低费用和获得机会。我们正在建设一个可持续的长期项目,在创建并添加新的实用程序的同时,我们还计划不断增加产品、功能和技术为平台赋能。现在仅仅是YIELD.APP故事的开始!”

YLD will be allocated as follows:

More details of Holding Rewards and Referral Rewards can be found in this article:https://yieldapp.medium.com/yield-launching-native-yld-token-5a48f2bb48ac

During the first 36 weeks after launch, our early adopters will:

1. receive YLD when they invest in a plan,

2. refer new users to our platform,

3. stake their tokens using our built-in feature,

or 4. simply hold assets in our secure multi-currency wallet. The max supply is fixed, and YLD will also be tradable on exchanges.

We're excited to hear everyone's thoughts and additional questions about our token document: https://medium.com/@yieldapp/yield-launching-native-yld-token-5a48f2bb48ac

Its a similar to a BNB type model. Its key to our entire ecosystem and used to reduce fees and gain access to opportunities.

As we are building a sustainable multi-year project, we plan to create and add new utility as we continue to add products, features and technology driven niches to our capabilities, this is only the start of the YIELD.APP story.

107

107

103

103

102

102

102

102

96

96